As the national holiday approaches, outbound tourism from China is expecting its peak time. To meet this drastic demand, UnionPay International ("UPI"), a leading global payment provider, announced today that merchants in countries including Bosnia and Herzegovina, and Chile began to accept UnionPay cards for the first time, contributing to the total number of countries and regions covering UnionPay service to 176. Financial institutions in Bahrain, Madagascar began to issue UnionPay cards, and the total number of UnionPay cards issued outside mainland China surpasses 120 million.

UnionPay started its global business in 2004. Over the past 15 years, the company has largely expanded its service acceptance footprint, serving global cardholders. Meanwhile, UnionPay has also brought digital payment technology overseas to build a widely connected global payment network. For the booming cross-border transaction sector in China, UnionPay has become an iconic symbol for the Chinese payment system in the world.

Globally accepted

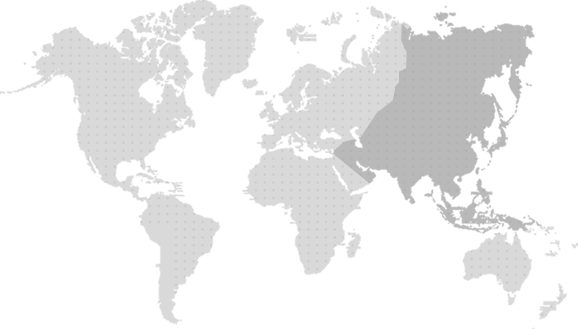

According to UPI, UnionPay is now accepted by over 28 million merchants across the globe. In Asia, UnionPay payment is available in about 90% of the merchants; UnionPay cards can be used in 90% of countries and regions in Europe. Meanwhile, some 90% of merchants in the US and Australia now accept payments with UnionPay credit cards. Statistics from UPI also reveal a growing acceptance rate in emerging travel destinations such as Russia, where the overall acceptance rate of UnionPay card will reach 100% within the year; 80% of merchants in Africa accept UnionPay payments.

In addition to expanding acceptance, UnionPay cards are increasingly versatile. Statistics from UPI show that over 70 international airlines now accept online purchases made via UnionPay cards. In some 20 popular destinations for self-driving tour, travelers can pay the rent for vehicles with UnionPay cards. Among the 10 top hospitality brands, the acceptance of UnionPay has surpassed 70%. UnionPay is also accepted by Chinese embassies and consulates in 31 countries and regions.

Global cardholders

In June, the Portuguese Commercial Bank, the largest private bank in the country, issued its first UnionPay card. According to the coverage on Les Échos, a French financial newspaper, the issuance shows that UnionPay is now serving not only Chinese tourists but also local residents, and UnionPay is the new payment option for European consumers.

The first UnionPay card outside mainland China was issued in 2004 in Hong Kong. Since then, UnionPay has stepped up efforts in making card issuance a local business in the global market. In 11 years, the number of cards issued surpassed 50 million. However, after that, it only took three years of UPI to double that number. Now the total number of UnionPay cards in 57 overseas countries and regions has surpassed 120 million. Statistics from UPI also reveals an increase in transaction volume among these cards of nearly 40% in the first half this year. UnionPay is increasingly become the preferred payment tool for global cardholders.

The rapid growth in card issuance and the popularity of UnionPay as a payment method is largely due to China’s further opening up and the increasing demand for cross-border transactions. According to UPI, the Belt and Road Initiative has generated an increase of 50 times the number of cards issued in the countries and regions featured in the initiative. The total number has reached 83 million. UnionPay has become the prime option for card issuance in Laos, Magnolia, and Myanmar. It is also widely used among the local residents in Russia, Kenya, the Philippines, and the UAE as the payroll card, student card, and citizen card.

UnionPay apps around the world

UnionPay is also working on technologies and innovation to better “go digital”. The UnionPay mobile application, UnionPay app, now has over 200 million users. It is increasingly accepted by overseas merchants. Consumers can just pay via UnionPay mobile payment in more than 3 million merchants outside mainland China, according to UPI.

Since September 2018, UnionPay cardholders in Hong Kong and Macao can also attach UnionPay cards to the UnionPay app, making payments easier in The China Great Bay Area. Meanwhile, in 12 countries and regions in Asia and the Middle East, 21 digital wallets have been developed applying technologies from UnionPay. Users of these wallets could pay via UnionPay QR code globally by attaching UnionPay cards issued by local institutions or apply for digital UnionPay cards within the app.

UnionPay has created open platforms to make payment technologies more accessible and easy to integrate with other UnionPay financial products. UnionPay is also working on its payment solutions to include more financial institutions, communications, and retail companies to promote mobile payment experience of UnionPay global cardholders.

ATM Location

ATM Location

Exchange Rate Query

Exchange Rate Query

Featured offers

Featured offers