Cai Jianbo (2nd right), CEO of UnionPay International and Wang Xiquan (4th right), Vice President of ICBC, Luan Jiansheng (3rd right), President of ICBC Peony Card Center attended the card issuing ceremony. In addition, Zhang Qiyue (4th left), Chinese consul-general in New York was also present for congratulations.

On April 26, UnionPay International and Industrial and Commercial Bank of China ( US) (hereinafter referred to as the “ICBC US)” jointly released the first UnionPay credit card (card number starting with 62) in New York. It’s both the first UnionPay credit card issued in the US market and the first credit card issued by a Chinese commercial bank in the US. Cai Jianbo, CEO of UnionPay International and Wang Xiquan, Vice President of ICBC, Luan Jiansheng, President of ICBC Peony Card Center attended the card issuing ceremony. In addition, Zhang Qiyue, Chinese consul-general in New York was also present for congratulations.

UnionPay and ICBC are significant strategic partners to each other, with highly integrated internationalization strategies. They work closely worldwide in such aspects as acceptance, issuance and innovative payment of UnionPay cards.

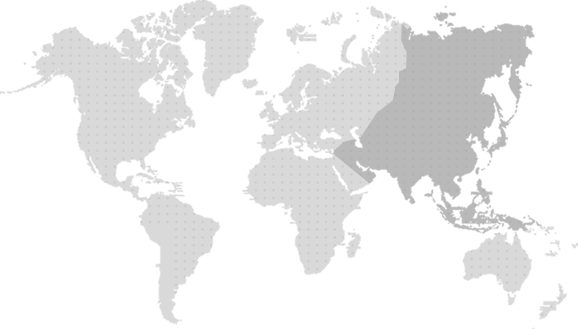

Continued expansion of UnionPay overseas acceptance network meet payment needs of cardholders with international issuers such as ICBC. Furthermore , UnionPay International helps to extend brand, products and services of Chinese banks overseas via overseas cooperation with Chinese banks. So far, UnionPay International has worked with ICBC to issue cards in more than 20 countries and regions such as Canada, New Zealand and Singapore.

The UnionPay credit card jointly issued this time is to deliver the secure, convenient and preferential payment to American residents constantly travelling between China and other Asia-Pacific countries, overseas Chinese in the US and overseas students based on the UnionPay card acceptance network distributed among 157 countries and regions as well as the international financial service platform of ICBC. The UnionPay credit cards issued this time include “Preferred cards” and “Premier cards”. The former is exempted from annual fees and offers cashbacks. The latter offers more cashbacksand more considerate VIP services.

According to Cai Jianbo, China US travel Year will promote personnelexchanges between the two countries and UnionPay cards will offer more convenient and considerate payment services. UnionPay networks in the Us can meet card using needs of cardholders with enriched privileges and optimized experience.Mainstream e-merchants and prestigious universities in the US have achieved online acceptance of UnionPay cards; Based on improved acceptance environment, we work with ICBC in issuing UnionPay cards. It will offer new payment choices for local residents, attract more US customers to travel to China and support bilateral exchanges.

According to Wang Xiquan, 2016 is the China-US Travel Year and travel exchanges of the two countries has entered a brand new stage. The credit cards issued this time is meant to suit financial needs of customers, facilitate economic exchanges, and serve local customers. ICBC aims to be a reliable international bank and issuance of the first UnionPay credit cards in the US, the origin of credit cards is a milestone for its international development.

Over 54 million UnionPay cards have been issued in overseas markets. The US has witnessed the unremitting perfection of the service system of UnionPay cards. Currently, UnionPay cards can be used to withdraw cash from almost all the ATMs in local. In addition, it is available for cardholders to use UnionPay credit cards for purchases via signature verification at 80% of merchants, or through password keyboard if such system has been installed at merchants. The majority of UnionPay credit cards issued by national or regional banks in China support signature payment, and cardholders can cancel their transaction password with corresponding issuing banks before their departure for the purpose of PIN-free payment.

ATM Location

ATM Location

Exchange Rate Query

Exchange Rate Query

Featured offers

Featured offers