Large-scale deployment of UnionPay QR Code will pave the way for more local consumers to go cashless with the adoption of digital payments on UnionPay enabled e-wallets

Global payment network UnionPay and leading Fintech company Razer Merchant Services (RMS) are collaborating to enable UnionPay Quick Response (QR) Codes at all Razer Merchant Services’ (RMS) physical merchant touchpoints and online merchants in Malaysia. In line with Bank Negara’s vision for a cashless society, UnionPay partners with the B2B arm of Razer Fintech, RMS, to enable QR Code acceptance at small, medium and big merchants across many industry verticals covering beauty, e-commerce, education, government services, healthcare, hobbies, parking, retail, telephony, travel and more.

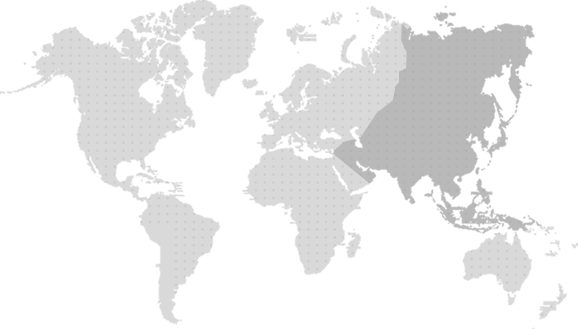

In 2018, UnionPay was the first global payment network in Malaysia to kickstart the nationwide deployment of UnionPay QR Code for payments. UnionPay QR Code is EMV-compliant – EMV is a global standard offering interoperability and reliability. Today, UnionPay’s QR Code is accepted at almost 100K merchant terminals locally, ranking it first among international payment networks in Malaysia. UnionPay’s QR Code coverage is also the most comprehensive globally, extending to 44 destinations and over 30 million merchants outside Malaysia, including destinations popular with Malaysian residents like Australia, China, Indonesia, Korea, Japan, Singapore, Thailand, and Vietnam.

“As one of the leaders in innovative payment, our vision is to always build and expand a strong eco-system of QR Code merchant network to foster convenience and seamless payment experience for customers using UnionPay-standard e-wallets with BOC, Boost, GoPayz, and S Pay Global. Thus, we are especially pleased to enable popular online merchants like eKhidmat, Elinking, exam-mate, Finestlife, Flowerchimp, Hermo, Livein, Penang Smart Parking and more for QR Code payment, allowing our customers to easily scan UnionPay QR Code online when making payment for everyday purchases and services, reducing physical contact and the need to commute,” said Mr. Huiming Cai, General Manager, UnionPay International (UPI) Southeast Asia.

UnionPay’s previous QR Code deployment have been more focused on offline merchants, but movement restrictions due to the pandemic have caused more of its customers to purchase online.

“RMS is pleased to collaborate with UnionPay, who have shown a firm commitment towards developing innovative payment products and services in Malaysia. This collaboration will further expand UnionPay’s online presence in Malaysia as the demand for QR Code acceptance is increasing, especially for many online marketplaces, e-services and e-commerce sites. Like UnionPay, we believe that QR Codes offers a secure, easy-to-deploy and low-cost e-payment alternative for online and offline Malaysian merchants. We are confident that RMS’ modular and scalable payment solutions will enable a superior payment experience for merchants of all sizes and their customers,” said Lee Li Meng, CEO of Razer Fintech.

Razer Fintech is the financial technology arm of Razer Inc. established in April 2018 and has grown to become Southeast Asia’s (SEA) largest O2O (online to offline) digital payment network with its online SEA payment gateway serving over 60K merchants in the region and its offline payment network covering over 1 million physical points in retail outlets across SEA.

UnionPay’s mobile payment includes QR Code for payment, and QuickPass (Contactless) payment. UPI has been actively building the eco-system for UnionPay mobile payment in Malaysia. In June 2021, UPI announced that it partnered with leading cashless parking provider Sonicboom Solutions Sdn Bhd to launch Frictionless Parking for GoPayz UnionPay customers to park in Klang Valley without using cash, card or collecting parking ticket. Frictionless Parking uses Sonicboom’s Licence Plate Recognition technology, a usage scenario in the UnionPay International Content & Service Platform (UCSP). The UCSP integrates various mobile payment scenarios into a mobile payment ecosystem, enhancing consumer’s payment experiences for everyday purchases. The usage scenarios include transit, parking, benefits, coupons, tax refund and others.

ATM Location

ATM Location

Exchange rate inquiry

Exchange rate inquiry

Featured offers

Featured offers