UnionPay International announced today that the number of UnionPay cards issued outside the Chinese Mainland has exceeded 100 million. The volume of transactions made with these overseas-issued UnionPay cards has grown by over 40% during the first three quarters of this year. In some markets outside mainland China, over 90% of the transactions made with locally-issued UnionPay cards happen locally.

In addition to providing cross-border payment services to customers in mainland China, UnionPay is speeding up the localization of its business overseas: Firstly, we are improving the quality of card issuance while increasing the scale of card issuance. As a result, UnionPay card has become a major payment option for daily consumption and cross-border travel of customers in many countries and regions, supporting the personnel exchanges between China and the rest of the world. Secondly, payment innovation has become a major driving force for the localization of UnionPay’s business outside mainland China. Overseas-issued UnionPay cards are equipped with more and more innovative functions, such as online payment, offering enhanced payment experience to overseas cardholders. Meanwhile, we are collaborating with e-wallet products overseas to accelerate the process of digital issuance of UnionPay cards.

UnionPay card issuance scale outside mainland China continues to grow

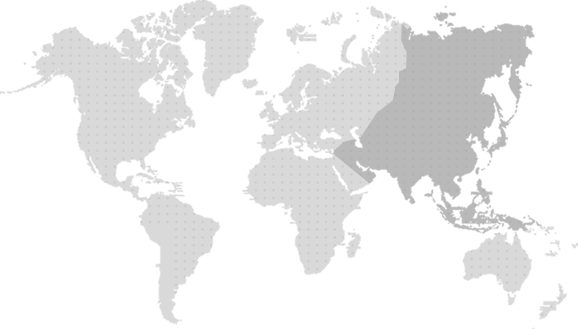

So far, a total of 100 million UnionPay cards have been issued in 48 countries and regions outside the Chinese Mainland, and the countries and regions participating in the construction of the Belt and Road have become major markets where large number of UnionPay cards is issued over the past few years. Along the Belt and Road, more than 35 million UnionPay cards have been issued in over 30 countries and regions, which is 20 times higher than that before the proposal of the Initiative. Among these markets, all of the 10 ASEAN countries and 6 Central Asian countries have issued UnionPay cards, and more than 10 banks in Russia have issued more than 1.5 million UnionPay cards. In addition, UnionPay is the No.1 card brand in terms of cards issued in Laos, Mongolia and Myanmar.

UnionPay is also making breakthroughs in card issuance in some countries and regions in Europe and the Americas. This month, UnionPay International and Bank of China Paris Branch have jointly issued France’s first UnionPay RMB-Euro Dual-Currency Debit Card to offer payment convenience to the personnel and economic exchanges between China and France. In the Americas, Panama issued its first UnionPay cards at the beginning of this year; Southern Commercial Bank Suriname has recently issued a variety of UnionPay card products; and East West Bank in the United States also plans to issue UnionPay cards in the near future.

UnionPay becomes the preferred payment method of many overseas residents

MINT, the UAE financial services group, has issued about 500,000 UnionPay payroll cards according to its cooperation agreement with UnionPay International. Chief Business Officer of MINT, Ali Faizan Rizvi, said that its cooperation with UnionPay has brought the best wage payment solutions to the local businesses and residents, and will further promote the development of inclusive finance in the UAE.

UnionPay card is also playing an increasingly important role in the daily life of customers outside mainland China. In markets like Hong Kong, Macau, Southeast Asia, South Korea, Pakistan, and Central Asia, over 90% of the transactions made with locally-issued UnionPay cards happen locally in terms of volume. UnionPay card is also the citizen card in Manila, the Philippines, and the payroll card for residents of the UAE, Russia and Uzbekistan.

With China being the third largest inbound tourism host country in the world, UnionPay is also providing payment convenience to overseas guests whom visit China. UnionPay RMB cards and dual-currency cards have been issued in about 20 countries and regions outside mainland China, saving the costs induced by currency conversion for overseas customers. Moreover, the volume of transactions in mainland China made with Pakistan-issued UnionPay cards have maintained a three-digit increase for three consecutive years. The volume of transactions in mainland China made with UnionPay cards issued in Uzbekistan, South Korea and Thailand have more than doubled since this year.

Innovation becomes the driving force of the localization of UnionPay’s overseas business

In recent years, UnionPay International has taken multiple measures to continuously improve the payment experience of cardholders outside mainland China. Firstly, it has enriched its overseas card portfolio and has launched premium card products, such as Themed Cards and Commercial Cards to meet the diverse needs of overseas customers. For instance, about 600,000 UnionPay Commercial Cards have been issued in over 10 countries outside mainland China. Secondly, UnionPay continues to improve its card-using services and benefits for overseas cardholders, providing privileges like merchant discounts, tax refund service, VIP service for Chinese visa application, and global assistance, etc. Since the beginning of this year, UnionPay International has cooperated with card issuers in 13 countries and regions overseas to launch a variety of card discounts for local residents. Thirdly, UnionPay is launching innovative payment products that are safe and flexible to meet the changing payment habits of overseas customers, enhancing the attractiveness of UnionPay.

Li Jingnan, a UnionPay cardholder in Hong Kong bound his card to the “UnionPay” mobile application once the app started serving cardholders in Hong Kong and Macau. He said that he often travels to the Greater Bay Area and the launch of the “UnionPay” app brings him great payment ease. In addition to Hong Kong and Macau, UnionPay cardholders in Singapore, Thailand and Vietnam can also bind the locally-issued UnionPay cards to local mobile payment applications to pay by scanning UnionPay QR codes at merchants. UnionPay cardholders in Hong Kong, Macau and South Korea can also enjoy UnionPay mobile QuickPass service which enables them to pay by tapping their mobile phones. Moreover, with more and more overseas-issued UnionPay cards are equipped with online payment function, the cross-border online transaction volume of overseas-issued UnionPay cards increased by about 40%.

Meanwhile, UnionPay International is accelerating the construction of its digital card issuance system based on e-wallet applications. In this September, UnionPay International partnered with the Singapore payment services group NETS to upgrade the local e-wallet NETSPay. Local consumers can download and register the e-wallet and enjoy UnionPay mobile payment service both in and outside Singapore. Next, UnionPay will launch more e-wallet products in Southeast Asia, the Middle East, South Asia and the Americas.

ATM Location

ATM Location

Exchange Rate Query

Exchange Rate Query

Featured offers

Featured offers